Happy New Year everyone! Hope you had a good start to the new year! It is about to get better, depending on where you are at in your property journey.

To know where we are going, we must first know where we are at.

Let’s get started on where the Property Market is in Singapore as of today!

Private Property Growth 2023

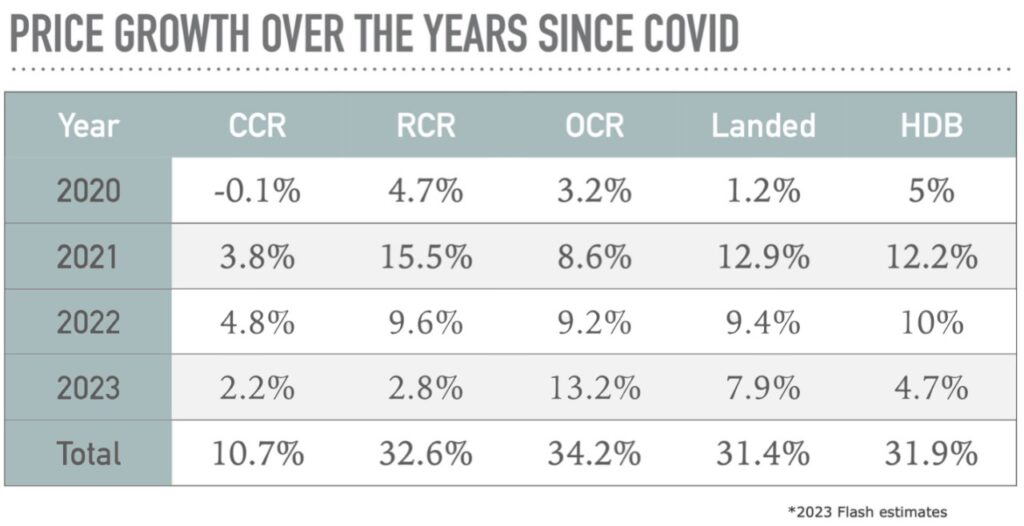

First off, the Private Property market has grown significantly over the past 3 years since 202. Almost all the segments across the board have blossomed by over 30%, with the exception of the Core Central Region ( CCR ), which grew only 10.7%. However, in the context of a S$1 million OCR property versus a 10.7% for a S$4 million CCR property, the numbers are still pretty impressive.

The Outside Central Region ( OCR ) private properties have seen the sharpest increase, and not only that, it had grown the most in 2023, whereas other regions have already started to slow down.

But why? As property prices surge, buyers are priced out of central regions and they started expanding outwards towards the OCR neighbourhoods. There is a beautiful dance, a cycle in which the real estate market performs.

Those who have bought in areas such as Pasir Ris, will start to see the prices surge in the 2nd Half of 2023, enabling early movers to enjoy a good profit in a shorter span of time.

Here’s a little example of the price growth for a well-located condominium in Tanah Merah.

The other factor is likely to be spurred by the HDB upgraders who took the opportunity to upgrade with their increased profits from 2020 to 2022. Many families are also upgrading quickly for bigger spaces or simply to reposition their assets better.

Looking at the quarterly growth, OCR does not seem to be slowing down by much towards the end of the year with growth still registering over 4% in the last quarter. Is this trend likely to continue into 2024?

The Landed segment has also seen great growth, especially in 2021 and a gentler growth in 2023.

Our Predictions for 2024

The price growth might slow down further this year but we are unlikely to see a steep drop in prices. (Sorry to disappoint those of you looking for a bargain!)

Instead, re-focus your energies to look for pockets of opportunities in the market. Last year, we managed to help some of our buyers lock in before the price surge, so straight up, they enjoyed $100k to $200k appreciation for private properties valued between $1m to $1.5m.

This year, you can capture the last wave in OCR (where the price gap is closing fast between New Launches and Resales Properties). The price cycle is likely to restart again in the CCR later down the year.

We also foresee more buyers returning to the market once interest rate declines later this year.

This is because as interest rates decrease, current homeowners can choose to refinance and stay put if they cannot fetch a good price for their property. It is also unlikely for them to lower their selling price as the replacement cost of their property will likely be higher as well.

HDB Growth 2023

In the HDB Market, growth is adjusting back to the pace before the pandemic – at 2-3% per year. Of course this growth percentage depends on the location of the HDB flats, since prime areas tend to enjoy greater growth.

With the announcement of the Plus and Prime category of HDB flats replacing the mature and non-mature estate categorisation, current HDB estates that share similar location with these future Plus and Prime estates become even more sought after.

For buyers of the resale HDBs in these areas, they get to enjoy the advantage of having only a 5 year MOP period and no restrictions of income ceiling during resale. So owners of these HDBs will see continued growth and demand for their flats, at least for the next 8 years.

Furthermore, the growth that we have seen in the past 2-3 years are spurred on first by the significant increase in the amount of grants given to resale HDB home buyers to encourage the purchase of resale HDB.

This is very much in line with the government plan to encourage home ownership and family planning without having to wait years for a BTO.

In 2023, HDB also rolled out more BTOs along with shorter wait times. Resale demand then began to taper off. The continual drop in quarterly growth in 2023 have also signal the return of interest towards BTO.

Our Predictions for 2024

Resale HDB prices will grow more gradually, except for those within the Prime and Plus areas.

After February, however, a cooling period of 15 months for Private Home Sellers would end. Rolled out in September 2021, private sellers at that point would have to wait out 15 months before they can get a 5 Room Resale HDB or larger.

So we expect to see more Executive Maisonette, Executive apartments and Jumbo Flats hitting the million dollar mark as the Private sellers re-enter the market after the cooling period of 15 Months is fulfilled.

So if you are looking to upsize, our recommendation is for you to get started as soon as you can, to avoid the battle with the ex-private home owners.

On the other hand, if you are aspiring to own a private property in the future, take action in the early half of the year.

As the larger HDB prices increases, more buyers may consider switching to private properties instead, creating more competition for you. Also, no matter how well these HDB flats will perform now, they will still pale in comparison with private properties in terms of growth and demand in the long run.

Still unsure of what you should do? Here’s some tips.

What should you do in 2024?

We always believe in starting early. Whether or not you take action now or tomorrow depends very much on your aspiration, priorities and financial planning.

1. Aspiration

Do you aspire to move into a private property or potentially own multiple properties as a way of building your wealth and legacy?

Think in terms of 5 years, 10 years and 20 years. Where do you hope to be?

2. Priorities

What priorities do you have at this junction?

3. Financial Planning

Considering the above 2, what numbers can you work with, to move towards your goals?

In case you are unsure, don’t do it alone, reach out to our team here.